The CARES Act: Putting Money in People’s Pockets

Last week, the federal government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This legislation is the third in a series of bills in response to the worsening COVID-19 pandemic. The first two bills taken together focused on critical prevention and treatment, free COVID-19 testing, and temporary paid sick and family leave policies for a swath of the American workforce through the end of 2020. Essentially, these first two bills aimed to shore-up the country’s critical public health infrastructure and enable workers infected with COVID-19 to stay home so as to prevent further spread of the virus. The third bill is aimed at stimulating the American economy, which has been devastated by the effects of the pandemic. This blog breaks down how two of the most important features of the bill, direct cash payments and enhanced unemployment insurance, will impact Americans struggling during the COVID-19 pandemic.

Income Replacement

As I highlighted in my last post, supporting Americans with cash is critical during these uncertain times because people are struggling to pay for a variety of basic necessities, and cash provides the flexibility for people to prioritize their own needs. Furthermore, as people use this cash to pay for groceries, rent, take-out, etc. they are also stimulating their local economy by providing revenue for local businesses. The CARES Act includes multiple benefits intended to put cash directly into the pockets of Americans. Specifically, the federal government will send a one-time payment of $1,200 to adults who make under $75,000 a year and an additional $500 per child– although most high school seniors and college students won’t get any money. Adults who make between $75,000 and $100,000 will receive a reduced payment depending on other qualifying factors. The Washington Post developed an easy-to-use payment calculator that takes the various factors into consideration so that anyone can estimate their one-time payment.

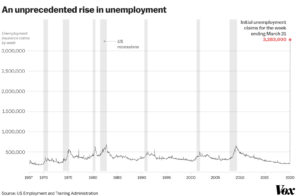

Aside from providing cash to large swaths of Americans, the CARES Act also enhances existing unemployment insurance benefits. Over 3.2 million people filed for unemployment insurance between March 15th and March 21st, which is the highest surge in unemployment claims ever recorded in one week. To put this number into perspective, the previous record for most unemployment claims in a single week was in 1982, when there were 695,000 claims submitted. Just to show how unprecedented this number of unemployment claims is, the graph below shows unemployment claims per week since 1967.

Source: U.S. Employment and Training Administration/Vox

The most recent week of jobless claims dwarfs anything that’s been recorded. The staggering number of unemployment claims is just one piece of a rapidly declining economic picture for millions of Americans, and it begins to convey why there is bipartisan support for such a large-scale stimulus.

For the millions of Americans who are losing their jobs, the CARES Act extends unemployment benefits by 13 weeks and adds an additional $600 a week for up to 4 months. Typically, states are concerned about raising unemployment insurance for fear of disincentivizing work. The thinking goes that if the benefit is too high, laid off employees will delay reentering the workforce. However, during a pandemic unemployed workers are not expected to immediately reenter the workforce because the economy is hemorrhaging jobs and typical job seeking behavior is no longer safe.

While everyone who obtains unemployment will gain these enhanced benefits, the amount an unemployed worker will receive will depend on which state they live in. The Department of Labor oversees the unemployment insurance system, but each state runs their own program which typically consists of up to 26 weeks of payments at about half of their previous wage. Each state provides a unique benefit cap ranging from $213 a week in Mississippi to $546 a week in Massachusetts.

Sustained Support?

These payments will be incredibly important for millions of struggling families, but the question then becomes – will this be enough? This pandemic is not going to disappear overnight, and families will be feeling the economic ramifications for months or even years. As the true scope and breadth of the financial disaster becomes more clear, lawmakers are going to have to come to grips with the need to make more sustained investments in the economy, likely putting more money in the hands of struggling Americans. Even before the CARES act was passed, leaders in congress were already discussing a fourth bill that would include future cash payments. But the legislative response has been a constantly evolving effort and bi-partisan support cannot be counted on as we begin to approach the election. It is encouraging to see the federal government make these initial investments, but hopefully we see a sustained commitment from policy makers that matches the seriousness of the crisis.